Lake Keowee Real Estate Expert Blog Keep em’ Comin!

We get a Lake Keowee listing, we get it sold. Quickly. How quickly? There…that quickly. That’s been the theme lately. The fast turn-around time on listings of Lake Keowee property has led to a great situation for you potential sellers. Let’s say you’ve been sitting on that Lake Keowee waterfront lot (or interior with boat slip) for years, hoping to do something with it but never finding the time. Well, maybe now is the time to turn it around quickly and get maximum dollars before the end of 2023 and the presidential election year of 2024. This also works for Lake Keowee waterfront or interior homes, by the way.

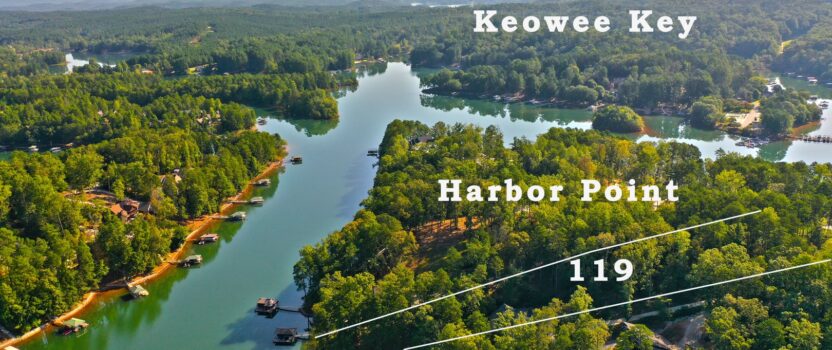

Another impressive week if we say so our darn selves (if you can’t say it in your blog, where can you say it?). We were able to put 2 houses and one Lake Keowee waterfront lot under contract. We’ve also added an interior lot with boat slip and are soon to add another Lake Keowee waterfront lot to our listing stable. On top of that, we closed on 2 condominiums in Clemson, an interior home in Keowee Key and another home. That’s just over a million dollars in closings. Give me some more of that!

Don’t forget, while you’re having such a good time reading this Lake Keowee Real Estate Expert Blog, keep in mind that we’re here to sell property. We need more listings to keep up this magnificent pace. Only you can help! Give us a call or an email and we’ll let you know what your property is worth and what kinds of things need to happen to improve its marketability. Don’t delay contact us today! 864-270-9186 [email protected] or [email protected] .

- NO more than 28 percent of your gross monthly income should be spent on housing expenses (principal, interest, insurance and taxes). This can vary upwards if you have a good credit history, liquid assets, or if you’re already spending more than 28 percent on your housing expense.

- Your total debt (mortgage and consumer debt) shouldn’t exceed 36 percent of gross monthly income. Again, people with good credit and liquid assets can often creep above this line.

As you compare your income to your potential housing expenses, keep in mind that your mortgage principal and interest are not your only costs. You also need to allow for any association fees, property taxes, insurance payments, etc.

Having said this, I should point out that the rules are looser than ever today. The “28 over 36” rule is no longer the ironclad guideline. Both the federal government and mortgage lenders have gotten very creative in their efforts to attract first-time buyers to the market. Today, there’s a loan program out there to put all but the worst-risk people into homes. But for your own safety and confidence down the road, your best bet is to adhere as closely as possible to the above guidlines.

One proposed subdivision could be about 4 miles away from the Rochester Highway and U.S. 123 Highway intersection. Photo by Caleb Gilbert