Lake Keowee Real Estate Expert Blog Winter

It’s finally here around Lake Keowee; the frigid days of winter. We’ve been able to skirt any real cold weather for longer than seems normal, but I believe it’s finally arrived in earnest. Except, we’ll probably have some days in the 70’s in a couple of weeks because South Carolina weather likes to tease. So, maybe it’s arrived in some other word than earnest, maybe intermittently, maybe that’s normal. Don’t know, best thing we can do is be ready for any type of weather (except 90-degree weather …maybe???). AHHHHHH. It’s all very confusing. Shall we focus on real estate? Yes, let’s!

Folks are less likely to go out for a day on Lake Keowee currently. There are plenty of those die-hard fishermen out there doing their best impression of Nanook of the North (it’s amazing what clothing manufacturers can do with modern fabrics to keep us warm), but very few folks are just cruising around for the giggles. There will be some of that in a couple of weeks as we will have a few communities doing their annual Christmas lights on your boat show. Those are fun to watch from the shore, a little more taxing from the water (see Arctic literary character reference above), but fun for folks who are willing to go the extra mile in extending the Christmas spirit.

Wait, I said we were going to focus on Real Estate… I digress. Fear not, it shan’t happen verily. We had a closing last week (Yea!!!), we have two closings this week (Yea!!!), we have a few tours this week (Yea!!!), overall business is much slower (Boooo) which is expected for December (Hmmm….OK?).

Perfect time for you buyers to get out and see some things with much less pressure on the buying decision than there was a few months ago and a much clearer view of everything since the leaves are off the trees. Sellers, get ready. You have a couple of months to get your property ready for the 2024 selling season. Now is the perfect time to contact us and set up a meeting so we can assess your situation and get you on the right track to getting that Lake Keowee property market ready!

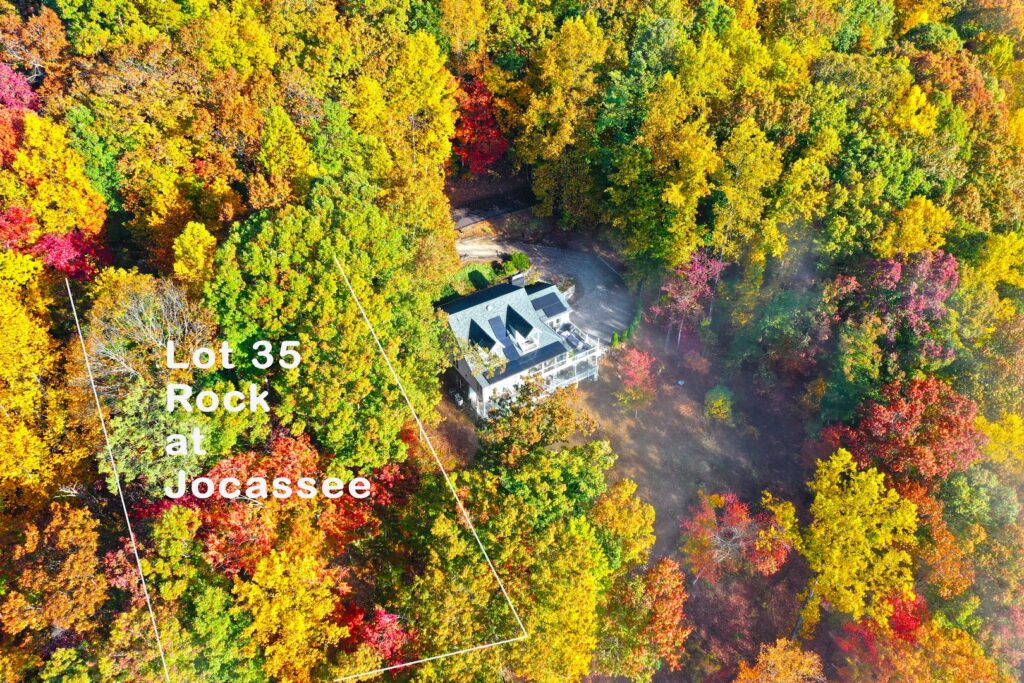

Lot 35 The Rock at Jocassee, Great Views!!!!

Duke Energy hosting annual Festival of Trees

Early morning!