Keowee Real Estate Expert Blog Dodging Rain Drops

It’s been quite a difficult thing avoiding the rain drops around Lake Keowee. We were fortunate to have a nice weekend which gave us an opportunity to get out and shoot some videos while the conditions were right. We were able to get three homes ready to hit the market and they are some good ones! We hope to have all three on the market by today or tomorrow giving you guys some more of the inventory you’ve been craving.

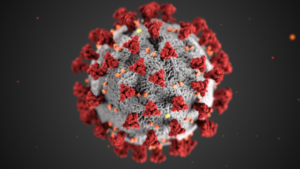

We were also able to get a home in Harbour Pointe closed along with two waterfront lots over the past week. That’s some special work with the way the weather has been and we hope to keep the ball rolling throughout the rest of the year. That is as long as the Covid 19 virus and the stock market taking huge losses don’t put a damper on things. Fingers crossed and preferable crossed at least 3 feet away from others.

As I keep saying, now is the time to get your property on the market. Spring will be here by the time all of the particulars are taken care of and your property will hit the market at the perfect time. Contact us so we can walk you through the process.

[email protected] or [email protected] .

- No more than 28 percent of your gorss monthly income should be spent on housing expenses (principle, interest, insurance, and taxes). This can vary upwards if you have a good credit history, liquid assets, or if you’re already spending more than 28 percent on your housing expenses.

- Your total debt (mortgage and consumer debt) shouldn’t exceed 36 percent of gross monthly income. Again, people with good credit and liquid assets can often creep above this line.

- As you compare your income to your potential housing expenses, keep in mind that your mortgage principal and inter45est are not your only costs. You also need to allow for any association fees, property taxes, insurance payments, etc.

- Having said this, I should point out that the rules are looser than ever today. The “28 over 36” rule is not longer the ironclad guideline. Both the federal government and mortgage lenders have gotten very creative in their efforts to attract first-time buyers to the market. Today, there’s a loan program out there to put all but the worst-risk people into homes. But for your own safety and confidence down the road, your best bet is to adhere as closely as possible to the above guidelines.