Lake Keowee Expert Blog

Nope, it’s not over in places close to Lake Keowee. The COVID– 19 virus is still with us more so every day apparently. Around Clemson University, several students that have returned to the area have tested positive for the virus. The football team reported 23 cases alone. You remember when you were 18 and you were virtually indestructible (yeah, me neither but we thought we were!) You didn’t need to social distance, a mask, sanitizer, etc. Well not everyone was that way, but certainly more folks felt that way in their 20’s than do in there 50’s. Apparently it’s showing with this spike. The good news is most folks appear to be asymptomatic (our vocabulary word for the week). Keep your fingers crossed it will stay that way, make sure you stay 6 feet away from folks, wear a mask and wash your hands habitually. It’s not the 18 year olds we need to worry about; it’s us 50+ year olds. We continue to be busy as to be expected this time of year. We were able to put a couple more lots under contract and show quite a bit of property. We also closed on more than $2M in property – pulling the corn while the sun shines! Problem we’re running into now is a lack of inventory. If you’ve been thinking about putting your home or lot on the market, DO IT NOW – while folks are out looking in earnest! Let us tell you what it’s worth and how we can get it out in front of as many curious eyes as possible.

[email protected] or [email protected] .

Lake Keowee Area News Corner

Important to note catfish aren’t always necessarily bottom fish

Important to note catfish aren’t always necessarily bottom fish

Catfish are mistakenly believed to be only a bottom-dwelling fish, but they can often be caught suspended around manmade structures during the summer.

Clemson City Council may require face masks

Clemson City Council may require face masks

Dockside Elevations

Increased virus levels found in city’s wastewater

Increased virus levels found in city’s wastewater

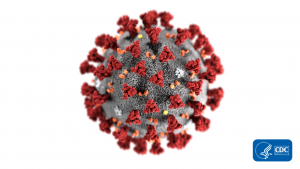

This illustration shows the 2019 Novel Coronavirus. The virus has been identified as the cause of an outbreak of respiratory illness first detected in Wuhan, China