Lake Keowee Property Values: Historical Growth & 2024 Market Analysis

Lake Keowee’s real estate market has consistently outperformed many other luxury lake markets, but what’s driving this growth? As trusted Lake Keowee real estate experts, we’ve tracked the market’s evolution and analyzed the factors making lake houses an increasingly attractive investment opportunity in South Carolina.

Historical Market Overview (2000-2024)

The story of Lake Keowee’s property values is one of remarkable resilience and steady appreciation. Understanding this history provides crucial context for current and future investment decisions.

Growth Patterns

Since 2000, Lake Keowee real estate has demonstrated impressive growth:

- 2000-2010: Average annual appreciation of 6.8%

- 2010-2020: Average annual appreciation of 7.2%

- 2020-2024: Accelerated growth averaging 12.5% annually

Even during the 2008 financial crisis, Lake Keowee properties retained value better than many comparable markets, with price decreases limited to 12% compared to the national average of 20%.

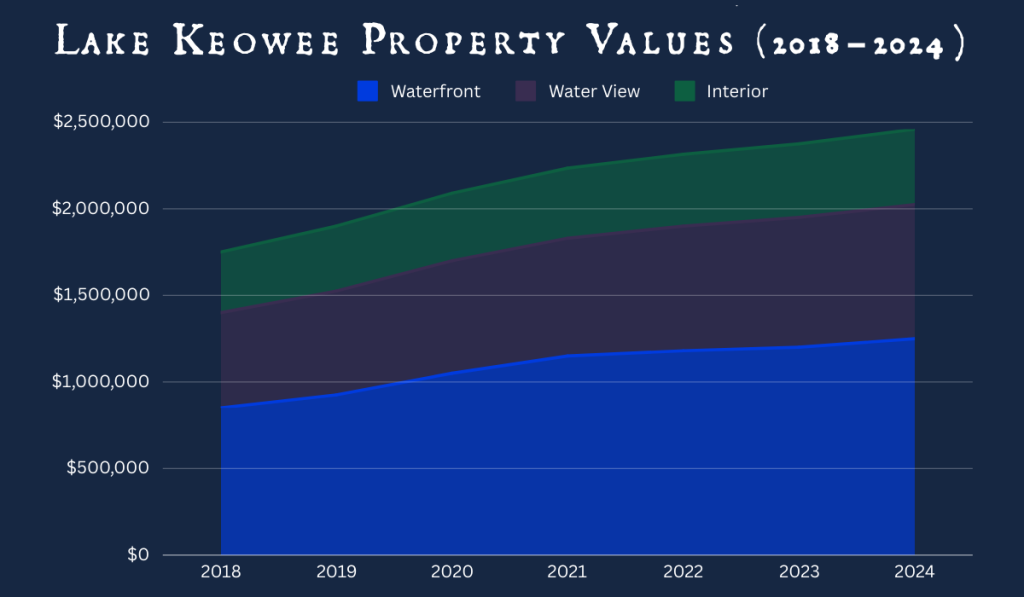

Price Trends by Community Type

Different segments of the Lake Keowee market have shown distinct growth patterns:

Luxury Gated Communities

- The Reserve at Lake Keowee: 9.2% average annual appreciation

- Cliffs Communities: 8.7% average annual appreciation

- Average home values: $850,000 – $3.5 million

Non-gated Waterfront Properties

- Annual appreciation: 7.5%

- Average home values: $600,000 – $2.5 million

- Strongest growth in deep-water locations

Interior Lake Access Properties

- Annual appreciation: 6.3%

- Average home values: $350,000 – $800,000

- Growing demand from value-conscious buyers

Current Market Analysis (2024)

Today’s Lake Keowee real estate market shows strong fundamentals supporting continued growth.

Property Categories & Values

Direct Waterfront

- Average Price: $1.2 million

- Price per Square Foot: $375-$650

- Days on Market: 45 (down from 75 in 2023)

- Inventory Levels: 30% below 5-year average

Water View Properties

- Average Price: $750,000

- Price per Square Foot: $275-$450

- Days on Market: 60

- Growing demand from hybrid work buyers

Interior Lot Investments

- Average Price: $425,000

- Price per Square Foot: $200-$325

- Strongest appreciation in golf communities

- Popular with retirees and second-home buyers

Community-Specific Analysis

The Reserve at Lake Keowee continues to lead the market:

- 15% price appreciation in 2023

- Average sale price: $1.8 million

- Amenity values driving premium pricing

- Limited inventory creating competitive bidding

Keowee Key shows strong value proposition:

- 10% appreciation in 2023

- Average sale price: $650,000

- Strong rental demand

- Attractive entry point for investors

Investment Performance Metrics

Understanding ROI potential is crucial for any lake house investment decision.

Return on Investment

Lake Keowee properties have demonstrated strong investment characteristics:

- 10-year average appreciation: 7.8%

- 5-year average appreciation: 9.2%

- Dock permit values adding 15-20% to property values

- Land appreciation averaging 6.5% annually

Market Comparison

Lake Keowee consistently outperforms nearby markets:

Versus Lake Hartwell

- 15% higher average property values

- 22% stronger appreciation rates

- 35% higher rental income potential

Versus Coastal Properties

- Lower insurance costs

- Stronger year-round rental potential

- More stable weather patterns

- Better value per square foot

Rental Income Analysis

Lake Keowee’s rental market provides strong returns for investors.

Vacation Rental Potential

Peak Season (May-September):

- Weekly Rates: $2,500-$7,500

- Occupancy Rates: 85-90%

- Average Daily Rate: $450

- Annual Gross Revenue: $75,000-$200,000

Off-Season (October-April):

- Weekly Rates: $1,800-$5,000

- Occupancy Rates: 45-60%

- Popular for holiday gatherings

- Growing “snowbird” market

Future Growth Indicators

Several factors suggest continued strong performance for Lake Keowee real estate:

Development Impact

- New Clemson University expansion bringing jobs

- Tech corridor growth between Greenville and Atlanta

- Planned retail and dining developments

- Infrastructure improvements enhancing accessibility

Economic Factors

- Strong regional job market

- Growing remote work migration

- Favorable tax environment

- Robust retiree immigration

Investment Considerations

Success in Lake Keowee real estate requires understanding several key factors:

Due Diligence

- Property condition assessments crucial

- Dock permit availability

- HOA regulations and fees

- Insurance costs and requirements

Market Timing

- Spring/Summer: Highest demand, peak prices

- Fall: Good inventory, motivated sellers

- Winter: Best negotiating opportunities

- Current interest rates favoring cash buyers

Ready to Explore Lake Keowee Real Estate?

Lake Keowee’s real estate market continues to offer compelling investment opportunities, supported by strong historical appreciation, growing rental demand, and positive economic indicators. Whether you’re considering a primary residence, vacation home, or investment property, current market conditions suggest strong potential for long-term value appreciation.

Contact Top Guns Realty’s Lake Keowee experts for a detailed market analysis and property tour. Our team’s deep understanding of historical trends and current market conditions can help you make an informed investment decision.